Stats

European music in numbers

IMPALA

- IMPALA represents over 6000 independent music companies and national associations across 32 countries in Europe.

- IMPALA Sales Awards represent over 150 million albums sold and €2 billion in revenue.

The independents

- The music sector consists of thousands of independents and 3 multinationals – “the majors”.

- 99% of music businesses are micro, small or medium sized enterprises – “the independents”.

- The independents are the innovators and early adopters, discovering new talent and producing 80% of all new releases. The independents also account for 80% of the sector’s jobs.

- The collective market share of the independents is nearly 40%. Majors dominate the top 100 charts, as they account for over 95% of market share for the top hits across all genres.

- In 2018, record companies invested $4.1 bn in discovering and nurturing new artists (A&R).

- In 2018, 81% of Merlin’s members – the global digital rights agency for independents – saw their overall business grow, with 30% stating that business was up by more than 50%.

- 54% of Merlin’s members surveyed in 2019 reported that digital income accounted for more than 75% of their overall business revenues.

- In 2017, 31% of the independent labels’ revenue came from foreign markets, and 77% of artists signed to independent labels chose to renew their contract.

European music

- European cultural & creative sectors account for 4,4% of EU GDP and 7.6 million full-time jobs.

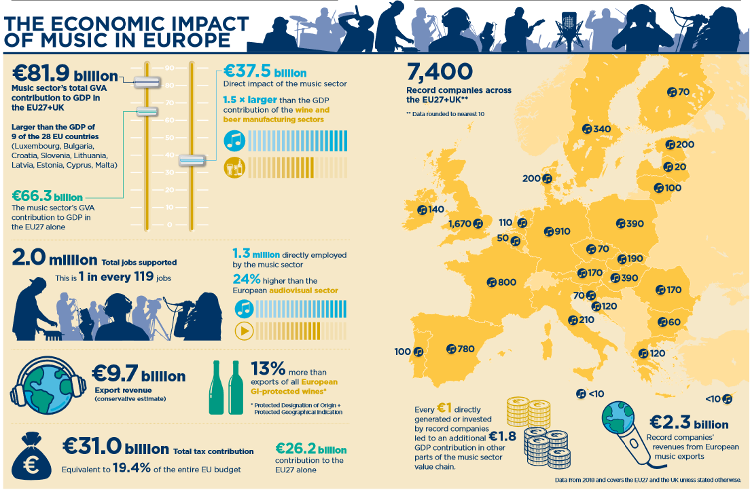

- The European music sector specifically is supporting 2 million jobs, contributing €81.9 billion in gross value added to GDP, and exporting €9.7 billion worth of goods and services to countries outside the EU27 and UK.

- Europe generates nearly a third of total recorded music revenues worldwide.

- Europe’s share of the global recorded music market was 27.7% in 2022, with a total of $7,3bn revenues – a growth of 7.54% year on year, marking the fourth consecutive year for growth in the region. This is far below the 15.7% growth recorded in 2021, which was exceptional as the market recovered from the impact of Covid-19. But 2022 remained a strong performance overall. Set in a 5-year context, it was even one of the best years for European growth.

- Streaming revenue in Europe grew by 11.9% in 2022 to $4.6bn, representing 62.9% of the total European recorded music market.

- Ad-supported video streaming revenues grew by 14.6% to reach $471.m, their highest level ever.

- Performing rights revenues increased by 11% to a total of $1.4bn in 2022 – 18.7% of total European revenues. Europe remained the top region for performance rights revenues, accounting for over 56% of the world’s performance rights income in 2022.

- In Europe, physical revenues declined by 9.9% to amount to $1.08bn as revenues failed to match those recorded in 2021 which saw an exceptional performance due to recovery from the pandemic and shop closures. Vinyl however, continued to show double-digit growth and accounted for more than 50% of physical revenues in 2022.

- In 2021, Europe represented around a quarter of all users of subscription services globally.

- Copyright-intensive sectors account for 9.9 million EU jobs.

- Copyright-intensive industries make a positive contribution to the EU’s trade balance: net export of €15bn.

Music industry

- In 2022, global recorded music revenues totalled $26.2 billion. An increase of 9% compared to 2021 ($25.9bn).

- The music industry’s digital revenues (including streaming) now represent 70.6% of total revenues (2022).

- Streaming revenues specifically grew by 11.5% (year-on-year) to represent 67% of the total market (2022) – $17.5bn.

- Subscription streaming increased by 10.3% to represent this year again the bulk of total streaming revenues 68.8% – $12.7bn), while ad-supported streams and video streaming revenues also increased by 18.7% (up to $2.9bn) and 11.3% (up to $2bn) respectively (year-on-year change). The total users of subscription accounts (including family plans) grew by 15,8% in 2022, amounting to 589m. The growth in ad-supported audio and video streaming revenues was helped by a revenue growth in global social media platforms by 30.9% (e.g. TikTok, Facebook, Instgram), but revenues from video stream continue to represent the smallest revenue stream across all streaming revenues by sub-format.

- In 2021, streaming revenue alone exceeded total industry revenue in each year from 2009 to 2016. Over 50,000 artists generated $10,000 from Spotify alone — and likely over $40,000 across all recorded revenue sources, meaning that more and more artists are able to reach this milestone, and they are not coming necessarily from the top music markets. 34% of them live in countries outside the IFPI’s top ten music markets (Australia, Canada, China, Italy, France, Germany, Japan, South Korea, the U.K., and the U.S.). In addition, on Spotify in 2021, only 12% of U.S. streams were of the top 50 artists.

- Number of users of paid subscription accounts grew by 12.6% to 589 million in 2022 (523 million in 2021),.

- Streaming aside however, digital revenues saw a drop of 11.7% this year, accounting for $644.4m.

- Synchronisation revenues increased over 22.3%, accounting for $640.4m and representing 2% of total revenues.

- Performance rights revenues grew by 8.64% to a total of $2.54bn, representing 9.4% of total revenues.

- Physical sales increased for the second year running by 4% to reach $4.6bn in 2022, although this did not replicate the prior year’s growth of 16.1% caused by a post-pandemic resurgence. They represented this year 17.5% of total revenues. Vinyl sales were up $200m this year (17.1% growth) to reach $1.54bn.

- 50% of top tracks played on radio and downloaded in Europe are American.

- Record companies invested $4.5 bn in research and development and marketing in 2015, representing 27% of these companies’ revenues.

- As a whole, the music industry invested 16.9% of its revenue in research and development for new artists in 2015. It is higher than other research-intensive industries (e.g. pharmaceuticals and biotechnology 14.4%, software and computer services 10.1%, aerospace and defence 4.5%, etc.).

- IPR‐intensive industries pay significantly higher wages than other industries, with a wage premium of more than 40%, with copyright-intensive sectors having the highest premium (69%).

Digital services and social media

- There are more than 230 digital music services available across the EU, providing access to more than 40 million tracks.

- 6 of the top 10 most liked people on Facebook are music artists (updated: June 2016).

- 7 of the top 10 most followed people on Twitter are music artists (updated: June 2016).

- 9 of the top 10 most watched videos of all time on YouTube are music videos. Out of the top 20, 18 are music videos (updated: June 2016).

The value gap

- YouTube makes up 47% of on-demand music streaming

- Video streaming overall makes up 52% of on demand music streaming (paid audio streaming 28% & free audio streaming 20%)

- In 2017, with 272m users audio streams (paid & free) generated $5.569bn, while video streams with 1.3bn users generated $856m

- Globally, 38% consume music through copyright infringement.

- Spotify paid record companies $20 per user in 2015 while Youtube returned less than $1 for each user.

- Merlin members report that video streaming services command 10 times more users than audio streaming services – but return less than 10% of the revenues

- On the perception of online platforms by Europeans, a Harris Poll (2019) found that:

- 64 % of Europeans polled believe that over the past 5 years the European Union has not done enough to regulate the power of the U.S. Tech Giants.

- 74 % of Europeans think that when the Tech Giants speak out on an issue, they do so to protect their own economic interests rather than the public interest.

- 80% of Europeans are in favor of the European Union implementing rules to guarantee the remuneration of artists and content creators for the distribution of their content on internet platforms.

Further statistics

- WIN global market share analysis of the independent music sector: download key statistics and the full annual report 2022/2023.

- The State of the Industry report 2022 – IFPI: click here

- The Economic Impact of Music in Europe is available – IFPI/Oxford Economics: click here

- IFPI Engaging with Music 2023 Report: click here

- Interesting report on domination of European radio by American repertoire, includes useful statistics on key territories, shows majors/independents’ market share, very scary… Cross Border Circulation of European Music Repertoire.pdf